Table of Content

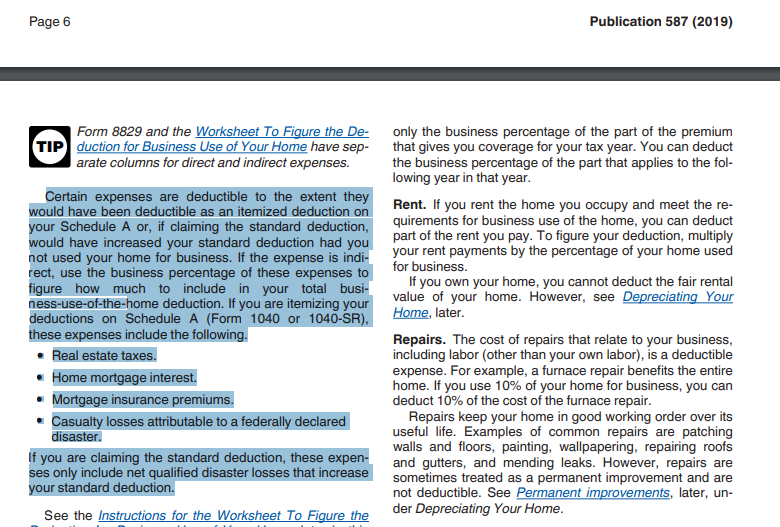

If you’re self-employed and work from home, don’t let the idea of filling out Form 8829 scare you away from taking advantage of the home office deduction. You can always opt for the simplified method if you don’t want to deal with tracking your actual expenses. In tax year 2013, the IRS introduced a simplified option to calculate the deduction for home offices, as opposed to their more in-depth regular method.

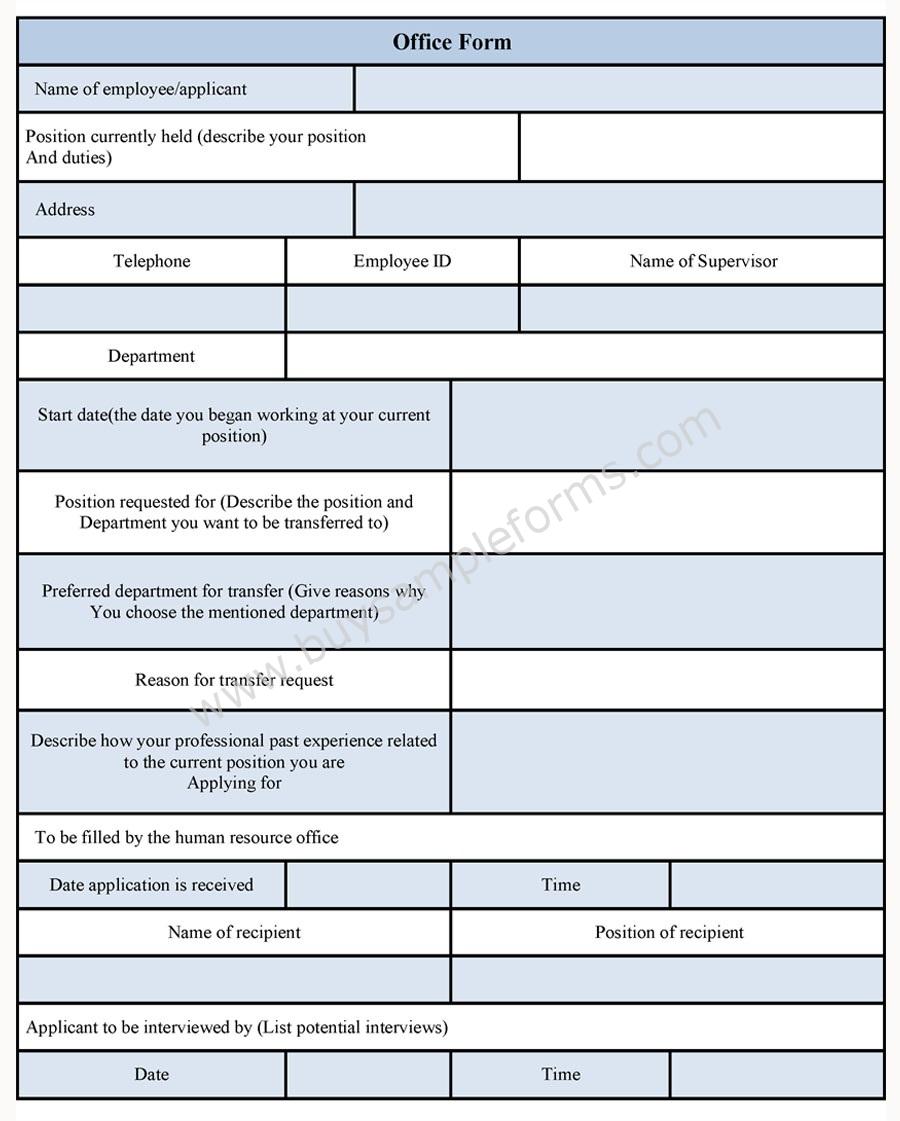

If you repaint your entire home, including the office, that’s an indirect expense. This guide will focus on the latter option to explain what Form 8829 is, and how to file to claim your home office deduction. Payroll management and employee management are integral to any organization.

What Is the Home Office Deduction?

Consider working with a tax professional to ensure you don’t make any mistakes and complete Form 8829 correctly. The $1,500 maximum for the simplified deduction generally equates to about 35 cents on the dollar for most taxpayers, said Markowitz. Because of this calculation, people with larger homes may not get as much using this method, said Adam Markowitz, an enrolled agent and vice president at Howard L Markowitz PA, CPA in Leesburg, Florida. You can switch methods year to year and should try to calculate both to see which will yield a larger deduction.

According to the IRS, there are two ways you can calculate how much of your home constitutes a home office and how much of your incurred costs are deductible. Placing a folding table in the living room does not qualify for a home office deduction. Let’s look at the rules for claiming the home office deduction and when and how to complete Form 8829. Compensation may factor into how and where products appear on our platform .

How Can Deskera Payroll Help?

The tax break is generally only for those who are self-employed, gig workers or independent contractors, not those who are employed by a company that gives them a W-2 come tax season. There are some parameters when it comes to who is eligible for the home-office deduction, even though millions of Americans worked from home in 2021 due to the ongoing coronavirus pandemic. The home office deduction Form 8829 is available to both homeowners and renters. To do this, you’ll need to know the adjusted basis of your home or fair market value and enter whichever one is less on line 37.

But if your deduction exceeds that limitation, you may be able to carry it over and claim it in the next tax year. As with the regular method, your deduction can’t exceed the gross income you derived from the business use of your home, less business expenses. And if it does, you can’t carry any excess deduction over to claim it in the next tax year.

When Would You Need to File IRS Form 8829?

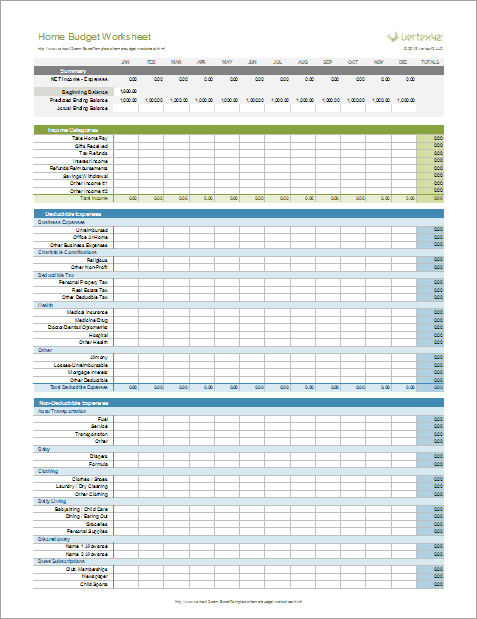

Now, at tax time, it’s important for workers to understand the home office tax deduction requirements and the specific deductions they may be eligible to take on their tax forms. It’s easy to forget what direct and indirect expenses you’ll want to claim when taxes roll around. Home repairs that happened in January feel like a very distant memory over a year later. Keep a list and receipts of everything, both direct and indirect expenses, that you can use when filling out the form.

The regular method allows for carrying over the deduction for eligible filers. Our Full Service Guarantee means your tax expert will find every dollar you deserve. Your expert will only sign and file your return if they know it's 100% correct and you are getting your best outcome possible. If you get a larger refund or smaller tax due from another tax preparer, we'll refund the applicable TurboTax Live Full Service federal and/or state purchase price paid. To claim the home-office deduction in 2021, taxpayers must exclusively and regularly use part of their home or a separate structure on their property as their primary place of business.

“Exclusive use” means you must use the specific space only for business purposes. The space can be part of a room and it doesn’t have to be physically marked off to qualify. You don’t have to meet the exclusive-use rule if you use that part of your home for storing inventory or product samples, or for a daycare facility. A taxpayer can also meet this requirement if administrative or management activities are conducted at the home and there is no other location to perform these duties. Therefore, someone who conducts business outside of their home but also uses their home to conduct business may still qualify for a home office deduction. Should you qualify for a deduction in respect of a home office; enter the amount calculated next to the source code in the “Other Deduction” container on your Income Tax Return.

The major advantage of this deduction method is that you don’t need to itemize expenses and do complicated calculations. “Regular use” means you use that space on a regular basis, not just occasionally or incidentally. For example, if you use space as a home office where you go every month to pay bills, that’s regular use. But using it only once a year to prepare your tax return probably wouldn’t apply.

This includes a place where you greet clients or customers, conduct your business, store inventory, rent out or use as a daycare facility. You can use the simplified method in one year and the actual-expenses method in a later year. In this case, you must calculate the depreciation deduction for the later year. Keep in mind that the requirements for who qualifies for the home office deduction doesn’t change based on which deduction method you use. You can’t deduct depreciation for the part of your home used for qualified home business use if you use the simplified deduction method. However, you can still claim depreciation on other assets used for your business if you use the actual expenses method.

To start this section, you’ll need to enter your profit from Schedule C, line 29. That’s straightforward, but it can get tricky if you have any gains or losses from the business use of your home or if you work from another location as well as your home. The IRS instructions have more details on what to include on line eight if either of those situations applies to you.

Here’s a look at the information you need to complete each section. You can’t deduct depreciation of your home for the portion you use for business. There are only four simple parts to IRS Form 8829, and the instructions included on the form will help you understand exactly what needs to be entered on each line.

The catch is that the regular method is more work than the simplified. It involves adding up the actual expenses of maintaining your home for the year and multiplying the total by the percentage of your home’s total square footage that is used for business. Some workers and business owners may be able to deduct home office and related expenses on their annual tax returns. The IRS Form 8829 helps taxpayers make these calculations and guides them through everything they can and can’t claim for home office deductions. Filers will take the deduction in different ways depending on the method used to calculate it. Those who use the simplified method will take the deduction directly on Schedule C when reporting income and expenses for their business.

However, those who calculate deductions using the standard method will submit a Form 8829 along with their tax return. After that, they will report the total deduction from the business income on Schedule C. However, if you can document your home office deduction diligently, don't be afraid to claim it. The Home office deduction form 8829 helps you analyze what you can and cannot claim. In this case, some of the household expenses can be written off, which may eventually lead to tax cuts. This is known as the Home Office Deduction and is one of the most misunderstood and popular types of small business owners' tax deductions.

That means you use your home to conduct a substantial portion of your work. Your home office doesn’t need to be the only place you do business, but it should be a place that you regularly and substantially use in the ordinary course of business. And if you have a separate structure, like a studio or garage, that you use exclusively for business, you may still be able to deduct expenses for it, even if it’s not your principal place of business. The deduction allows you to reduce your taxable income based on certain expenses related to using part of your home for business.

No comments:

Post a Comment